Let's model a prediction of the upcoming election based on a crypto betting website, and see if it's possible to make some easy money from it using arbitrage.

If you don't care what a prediction market is, just be aware of the following facts:

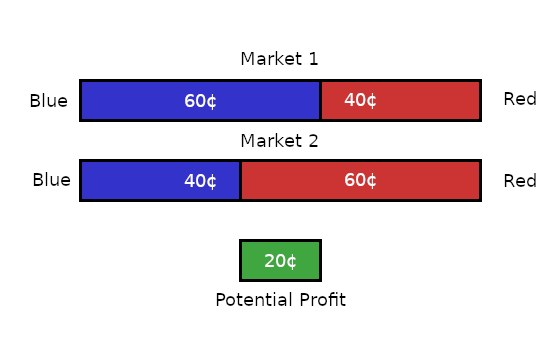

Arbitrage is all about finding gaps between the prices of commodities in different contexts. Normally, prediction market arbitrage would involve finding a gap in prediction values on two different prediction markets, and then buying the undervalued bet on either market. That way, no matter which side wound up winning, you would earn back the price gap as net profit.

You buy a 40¢ bet on Red in Market 1, and a 40¢ bet on Blue in Market 2, for a total cost of 80¢. Then, no matter which way the market resolves, you make back $1, for a total profit of 20¢ risk-free. Do this 200,000,000 times, and you can earn some decent pocket money.

The gaps between market valuations are much smaller in reality, and often outweighed by things like transaction fees or even slippage. In practice, the gap would shrink quickly as your buying activity drove both undervalued bets towards each other, and the markets are not large enough to withstand much arbitrage activity. In practice, this is a pretty crap way to try and make a buck. But the theory is simple enough.

What we're going to do is try to identify a similar gap within a single market. On Polymarket, there are prediction markets for the national presidential election at both national and state levels. Logically, these are equivalent: state level results aggregate into a single national election result (barring any shenanigans outside the scope of this project).

In practice, the state-level markets reveal a wildly different prediction for November than the national-level market. We can use a 538-style Monte Carlo simulation (see an example of this) to take all the state-level predictions and aggregate them into a single national probability, weighting by the electoral college.

I may later put a map visual here, but for now, the raw results:

| Data Source | Polymarket State-level Election Predictions |

|---|---|

| Date | May 11, 2024 |

| # of Simulations | 10,000,000 |

| Source Code | I wrote this |

This model run gave blue team a 38.2% chance to win, with 261 electoral college votes on average.

This strongly contrasts with the prediction market for the national election as a whole, which puts a Joe Biden victory at 45% as of 05/11.

45% is more in line with national polls, so we might assume that to be more likely. But regardless of the underlying truth, we should ask a couple questions about the data we've collected so far:

There is too much noise and uncertainty to make a straightforward arbitrage opportunity. Even if we assume that the Blue team wins the election, there's only a ~84% chance we'll be able to make a profit, and that profit will likely be on the scale of 1.25x or so — not nearly enough to offset the cost of counter-investing into a Red win prediction on the national market, which would be our insurance in a traditional arbitrage setting.

We can still make some above-average-intelligence investments, though. Let's start with valuation gaps: the difference between the likelihood of a state-level win as given by the market, and as needed to ensure a national victory. For example, Pennsylvania is given a ~50% chance of going Blue according to the prediction market, but in just the scenarios where Blue wins nationally, Pennsylvania has a ~70% chance of going Blue. This 20 percentage point gap represents an investing opportunity. Given the 7 point gap between state-level and national-level predictions, the PA-Blue contract is about two cents cheaper than it should be. A steal!

The corollary to this is that national-Red contracts are also cheap. 45¢ contracts for something that has a 63% chance of happening (according to the admittedly higher variance state markets) is another no-brainer.

This raises an uncomfortable reality, though. The national market actually has 45¢ contracts for both Red and Blue wins, with another 10 points distributed among third party candidates. If you want to make free money, go buy a bunch of Red and Blue national win contracts — there's a guaranteed 22% return either way.

Maybe the takeaway is that prediction markets are not a serious enterprise. In fact, maybe prediction markets are basically unworkable due to the same economic principles that are supposed to make them work. That's fine. There's real money being funneled into these prediction markets. You don't have to believe that they accurately model reality in order to profit off of them. You don't have to believe anything at all. Take this data for what it is: prices of contracts that you can buy or sell. Don't project too much real-world meaning onto a csv file full of decimals. Goes for all datasets, really.

I will do more research projects around the election as it draws closer. I'll update thiss page where appropriate. The "Last Updated" label at the top will track this. Thanks for reading.